In 2025, the traditional artificial intelligence stocks are entering a key point where investors start to cool down their optimism while valuation and market volatility remains high. Although AI is really the force changing all the industries, there was an overcharged sales approach at first which is now being replaced with more considered investment.

Market Dynamics and Investor Sentiment

As the AI sector is growing fast, most of the companies overstated the valuations and investors have begun to search for tangible outcomes and sustainable business models. Companies have once been the source of great capital on potential now they are with noted urgency to show real world use and profitability.

Performance of Key AI Players

Leading AI companies deliver mixed performances. For instance, now prominent on the market in the guise of an AI chip company Nvidia have hit the stock volatility because of regulatory problems and market saturation. As with other AI focused companies, they’re figuring out how to back validate their valuations without products in the market or cash flowing through the door.

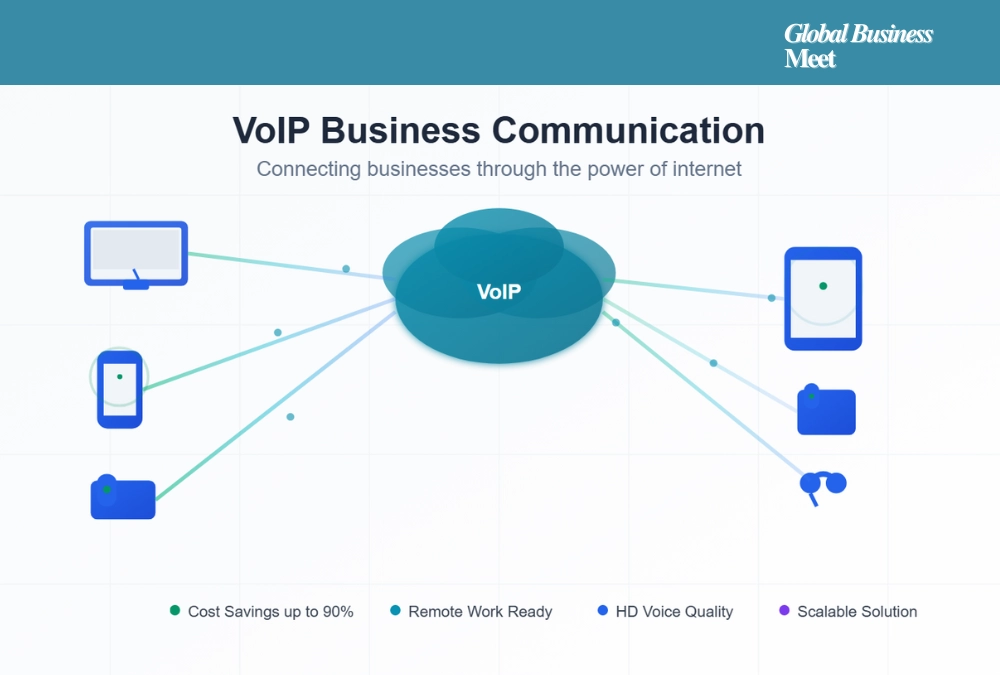

Shift Towards Practical Applications

The investors are now preferring the companies that offer the practical solutions with the real market demand. It aids sectors such as finances and healthcare, which according to the technology, could be made more efficient and more economies.

Outlook and Investment Strategies

You will see that in the maturing of the AI industry investors will be encouraged be watchful but opportunistic. The only way to reduce the risks involved with this sector’s volatility is to only consider those companies that have a track record, diversified portfolio and strong management. Secondly, it would be beneficial to monitor characteristics of ongoing regulatory developments and technological advancement which will help indicate long term future investment prospects.

AI is taking the lead to be an innovation, but the investment landscape is changing. If you wish to capitalize on the potential of the sector you must have a balanced approach which is done by undertaking due diligence and taking note of trending.