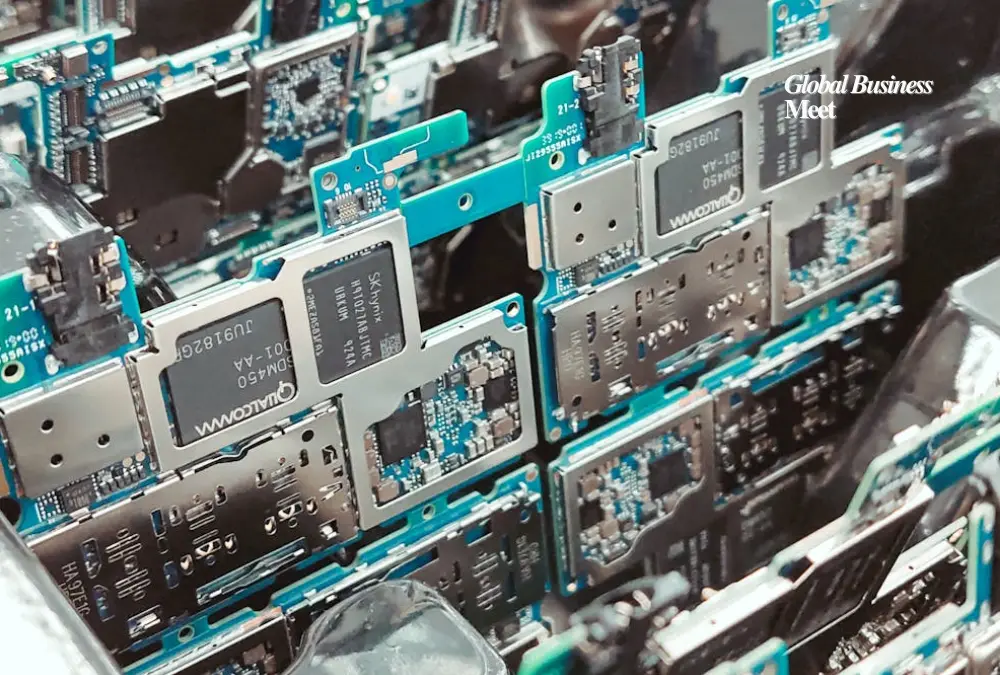

Nvidia, the chipmaking giant that has become the driving force behind the artificial intelligence boom, has taken a dramatic step to reshape the semiconductor industry. On Thursday, the company announced that it would purchase a $5 billion stake in Intel, a longtime rival that has struggled to maintain its position in recent years. Alongside the investment, the two companies revealed plans to jointly develop chips for personal computers and data centers, signaling a new chapter in their relationship.

The news immediately sent Intel shares soaring by 23 percent, lifting the company’s market value to $143 billion. Intel’s stock is now up about 52 percent since the start of the year. Nvidia, already valued at more than $4.2 trillion, also gained 3.5 percent on the day of the announcement.

A Boost for Intel After Years of Decline

For Intel, this investment marks a pivotal turnaround. Once the undisputed leader in semiconductors, Intel has spent the past decade grappling with leadership changes, technical missteps, and a series of strategic setbacks. The company lost ground to competitors like Nvidia, AMD, and Broadcom, particularly in mobile processors and the increasingly vital market for AI chips.

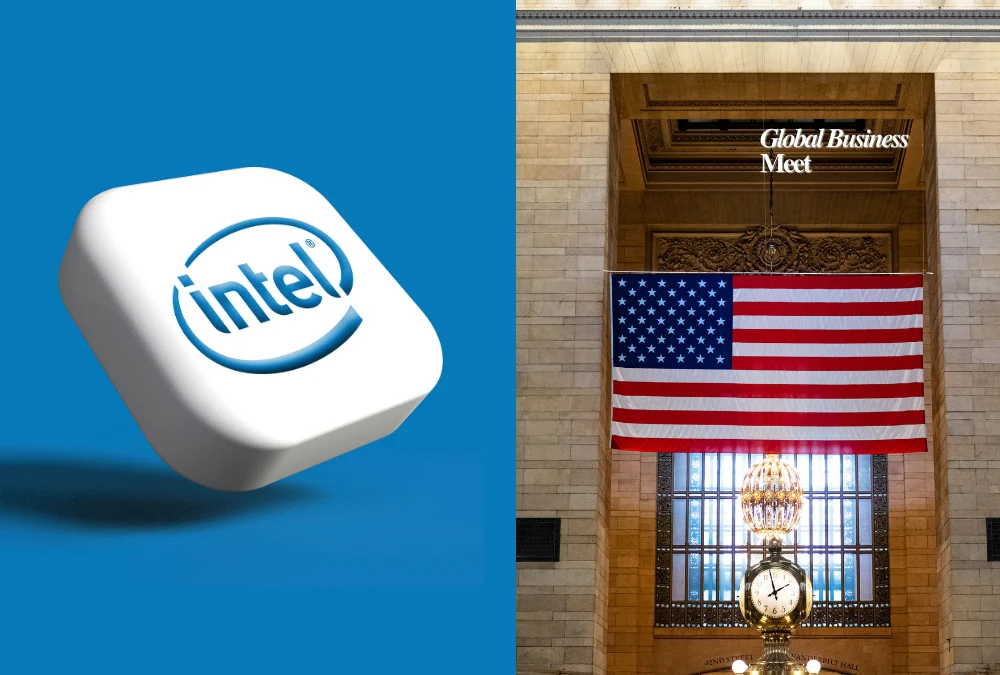

The arrival of Lip-Bu Tan as Intel’s CEO in March came at a turbulent moment. Sales had slowed, profit margins were under pressure, and investors had grown impatient. Yet the past few weeks have been transformative. In addition to Nvidia’s investment, Intel secured nearly $9 billion from the U.S. government, which acquired a 10 percent stake in the company. Japan’s SoftBank also poured in $2 billion, all part of a wave of support aimed at reviving Intel’s fortunes.

“This is a game-changing deal for Intel, placing them front and center in the AI race,” wrote tech analyst Dan Ives in a note. “Combined with the recent U.S. government investment, this has been a golden period for Intel after years of disappointment.”

National Security and the AI Arms Race

The moves are not just about corporate strategy. They are part of a broader geopolitical effort to secure U.S. leadership in artificial intelligence and semiconductor production. Washington has long viewed the industry as a national security priority, particularly as China has invested heavily in its own chipmaking capabilities.

Ives pointed out that Nvidia’s decision to back Intel strengthens America’s position in what he described as the “AI Arms Race.” He argued that Intel, once seen as a laggard, could now become a key catalyst for U.S. dominance.

It is extremely rare for the U.S. government to directly purchase shares in a private company outside of moments of financial crisis. That alone underscores the urgency with which policymakers are treating the semiconductor sector.

Political Drama Around Intel’s CEO

The political backdrop has been just as dramatic as the financial one. Only weeks ago, President Donald Trump publicly called for Intel CEO Lip-Bu Tan to resign, citing concerns raised by Senator Tom Cotton about Tan’s previous work with Chinese firms. Trump described Tan as “highly conflicted” in a social media post.

Yet the situation shifted rapidly after Tan and Intel’s leadership team met with Trump in the Oval Office. Following that conversation, Trump praised Tan’s career as an “amazing story” and softened his stance.

Within days, the administration announced its own investment in Intel, funded through the Biden-era CHIPS Act. The bipartisan law was designed to boost domestic semiconductor manufacturing and reduce reliance on overseas suppliers. The timing of the deal highlighted just how quickly Intel’s fortunes had reversed.

Nvidia’s Expanding Global Role

Nvidia’s CEO, Jensen Huang, has also been a central figure in the political theater surrounding AI and semiconductors. He has become a familiar presence at Trump administration events and was recently spotted at a state dinner at Windsor Castle alongside Trump and King Charles III.

During Trump’s visit to the United Kingdom, Nvidia announced more than $14 billion in new investments for AI and data center infrastructure across the country. At a press conference with U.K. Prime Minister Kier Starmer, Trump singled out Huang by name, declaring: “You’re taking over the world, Jensen.”

A Defining Moment for the Industry

For Nvidia, the decision to partner with Intel is a striking reversal of the companies’ long rivalry. It suggests that even the most successful players see value in strengthening their supply chains and expanding their reach in the face of soaring global demand for AI-capable chips. For Intel, the deal could mark the beginning of a long-awaited resurgence.

The stakes are enormous. The semiconductor industry underpins not only the future of AI but also the broader global economy. With Nvidia, Intel, and governments around the world committing billions of dollars, the competition is intensifying, and the outcomes will shape the balance of technological power for years to come.