The recently appointed CEO of Intel, Lip Bu Tan, has invested in at least hundreds of Chinese technology companies, including several connected to China’s People’s Liberation Army and Semiconductor Manufacturing International Corp (SMIC), China’s leading foundry champion. However, given that Intel is a close collaborator of the U.S. defense industry, the information is concerning.

Reporters reviewed corporate documents and found that Tan is in control of over 40 companies in China and is the minority shareholder in more than 600 Chinese firms through investment companies he runs or owns. At least $200 million is worth of shares then. Another Tan investment is a contractor and a supplier to the People’s Liberation Army. In numerous cases, Tan is invested alongside Chinese state possessed groups, or indigenous government funded investment finances.

Tan has made several of his investments through Walden International, an enterprise capital firm that he continues to head. Through Sakarya Limited and Seine Limited, two companies based in Hong Kong, he has also made investments.

The US-based Lip-Bu Tan has invested in Chinese technology companies that are currently on the US Department of Commerce’s Entity List due to their alleged connections to the Chinese government, military, and secret services through his enterprise capital firm, Walden International, and combined commodities.

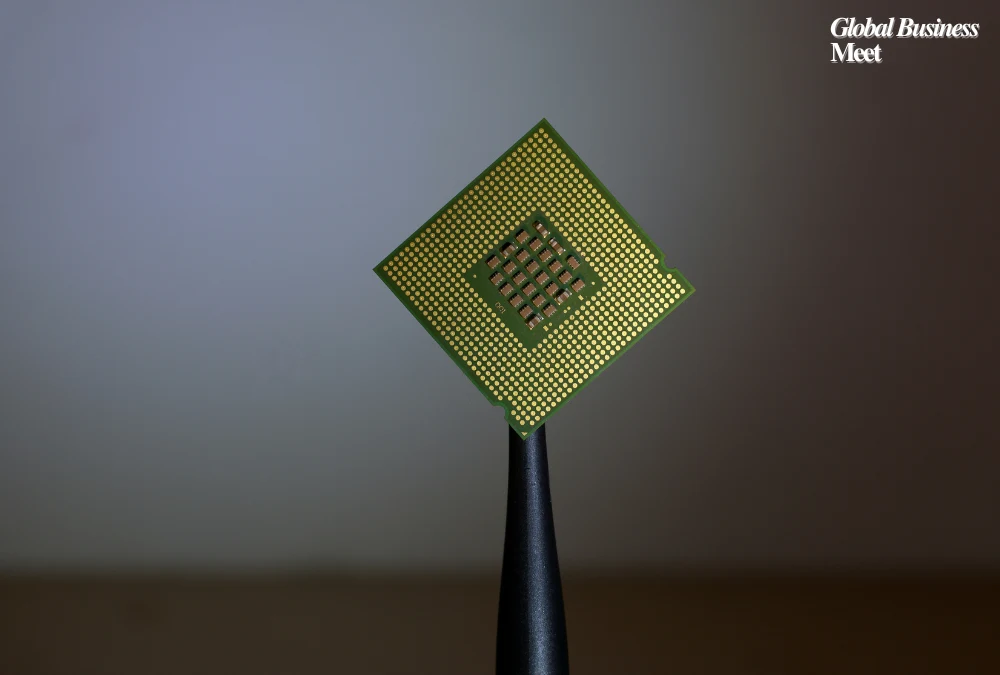

Other comparable businesses include Wuxi Xinxiang Information Technology Co. (a supplier to YMTC), Intellifusion (a surveillance company that sells technology to Chinese surveillance companies and flings for a PLA contract), Dapu Technologies (a PLA contractor), HAI Robotics (a PLA contractor and one of the stab for a PLA contract), QST Group (a supplier of detectors for Russian military drones captured in Ukraine), and SMIC (the leading chipmaker in China, with which Walden with its investment in its SMIC investment in 2021).

As of now, there is nothing illegal about holding shares in Chinese companies with links to the military and secret services unless the firm in question is listed on an American government restriction list, such as the U.S. Treasury’s list of Chinese Military-Industrial Complex Companies. Obviously, however, ethical concerns exist as to investing in any Chinese surveillance companies or any companies playing into providing technology to the Russian army.

Even if the Chinese businesses in Lip-Bu Tan’s portfolio are not even close to competing with Intel, their connections to the PLA do raise concerns. Since Intel is also attempting to become a foundry on its own, industry watchers further point out that it is unusual for a CEO to own stock in the company’s China contract chipmaker.

Tan’s ties to hundreds of Chinese businesses are seen as a disadvantage by some investors and analysts. Andrew King, a partner at Bastille Ventures, asked Tan during the conversation how he could manage the business considering that it has obvious defense connections. “This type of relationship should worry Intel’s leadership because it is likely to be in a political setting,” said Stephen Diamond, a law professor at Santa Clara University.

Tan’s deep experience with Chinese technology, however, is viewed favorably by others. Stacey Rasgon, a Bernstein analyst, claims that despite being little known to the general retail and investment public, Tan was a highly rewarded figure among investors for his decades in the business.

Intel, however, declined to comment directly on Tan’s investments and said he filled out a required form for company executives as per a rule set by the SEC.