Santa Clara, CA August 27, 2025: Nvidia has once again shown why it has been the heart of the artificial intelligence revolution across the world. The chipmaking giant reported an incredible increase of 56 percent in the amount of revenue amounting to Q2 totaling 46.7 billion USD, as compared to the same period last year. The results reflect the best quarterly sales that the company has ever registered and underscores Nvidia in the unparalleled position of driving AI advancement in the global arena.

A large part of this expansion was spurred by the data center division of Nvidia which generated sales of 41.1 billion, an increase of 56 percent year over year. At the center of this wave was the Blackwell architecture by the company, its most recent generation of AI-oriented chips, which contributed over 27 billion in revenue on its own. Cloud providers, research institutions and tech giants building out next-generation AI infrastructure are rapidly adopting these chips.

Profits Surge, But Investors React Cautiously

Nvidia registered 59 percent growth in net income of 26.4 billion in addition to record revenue, which is also 59 percent higher compared to the previous year. These kinds of numbers would have been a great spur to a market rally, but Wall Street responded cautiously. Stocks fell by between 2-3% in the after hours trade as investors assimilated the figures.

The dampened reception was an extension of a larger fear that despite its amazing performance, Nvidia is now a casualty of its own success. Expectations were high and even record breaking numbers were still considered as merely meeting expectations and not surpassing them. It is of great concern to the investors whether Nvidia will be able to maintain this rate of growth as the world economies and politics start to trouble it.

CEO Jensen Huang: The AI Boom Is Not over yet.

Jensen Huang, who is the company’s charismatic CEO, took the earnings call to illustrate a big picture of the future. He projected that in the next five years the world will spend between $3 trillion and 4 trillion on AI infrastructure. Huang suggests that the existing momentum is only the start of a decade long overhaul of industries such as healthcare and transportation.

Nvidia also provided a Q3 guidance with a forecasted revenue of $54 billion +-2. The forecast reflects confidence but there is one notable omission of the contribution of the company sales of H2O chip line, China.

The China Challenge

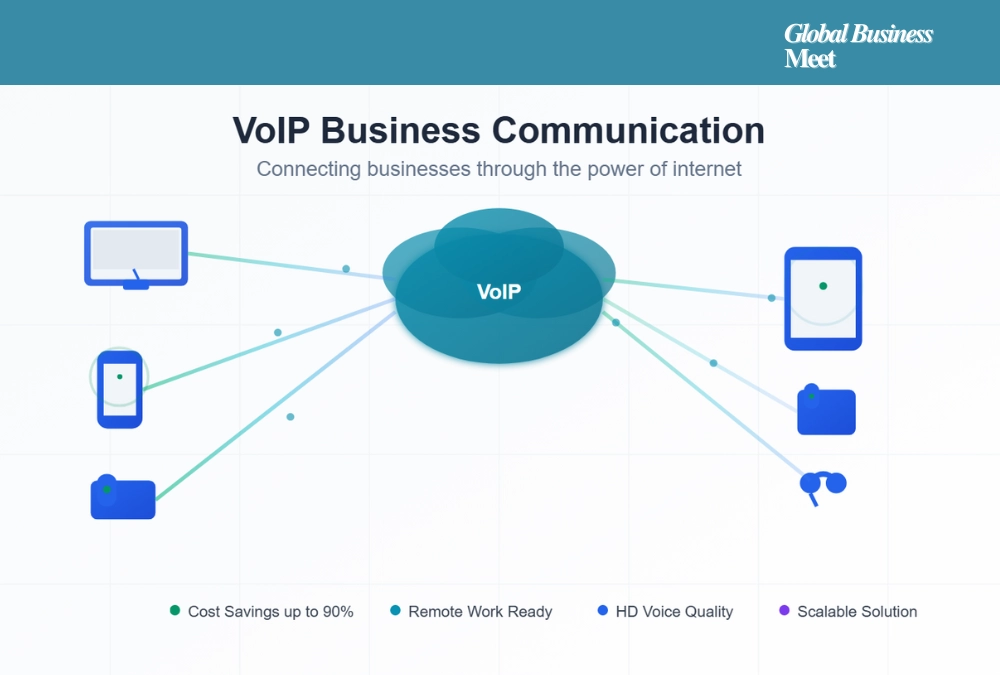

China has been a massive market of Nvidia since long ago, and the political relations in the region have been complicated due to geopolitics and the export ban of the United States of America. The firm disclosed that it had not sold any H2O chips in China in the quarter. Although the U.S authorities have already sanctioned some limited exports under a special scheme that was set to 15 percent of the revenue of Nvidia data centers, the collapse of supply chains and political challenges have been major obstacles.

Analysts observe that when Nvidia does not make sales in China, the performance of the company becomes even more impressive because the company was able to record record performance despite the loss of one of its biggest markets. Nevertheless, these restrictions pose a question of how they will affect the future in the long run.

Why This Matters

The results of Nvidia are not only a milestone of the company- it is a message to the whole tech industry. The fact that the company controls a portion of GPUs and AI accelerators renders its revenues an indicator of the larger AI economy.

The high performance is attributed to the growing momentum of demand among enterprises that are in a hurry to develop AI models, cloud computing, and advanced research environments. The biggest clients of Nvidia include firms such as OpenAI, Meta, Amazon, and Google, and their patterns of spending influence the overall market in the world.

Meanwhile, a number of worries about an AI bubble are being raised. According to some analysts, over-speculation in AI stock can accelerate the curve of real-world adoption, which can be volatile to Nvidia and other market leaders.

Market Sentiment: Hope Weds Doubt.

Although the fundamentals of Nvidia are extremely robust, the market is divided. Optimists refer to the unparalleled technological advantage of the company, massive order backlog and growing product pipeline as evidence that further growth can be expected.

Skeptics, nonetheless, point out two principal threats, which include geopolitics and saturation. The Nvidia -China tech competition might keep limiting its operations in other global markets, with rivals such as AMD and custom chip producers striving to cut Nvidia off. In the meantime, there are concerns whether the demand to AI chips will be this high once the first wave of infrastructural deployments decelerates.

What Comes Next for Nvidia

In the short term, Nvidia has several immediate priorities to consider in terms of Blackwell chip manufacturing to satisfy the existing demand and be ready to introduce the next-generation architectures. It has been reported that Nvidia has already started working on the B30A series which is aimed specifically at the markets that were affected by export controls.

Simultaneously, the company will have to strike the right balance between its innovativeness pipeline and expectations held by investors. Shareholders will desire to hear not only more records but also sustainable diversification other than record scale data centers. Further product lines like autonomous vehicles, edge AI and enterprise adoption may be essential to keep the momentum.

Nonetheless, these difficulties do not mean that Nvidia is not the most significant firm in the AI era; its performance in Q2 confirms this fact. Its chips have been the foundation of AI infrastructure boom, and its weight is much larger than semiconductors- it determines the course of global technology itself.