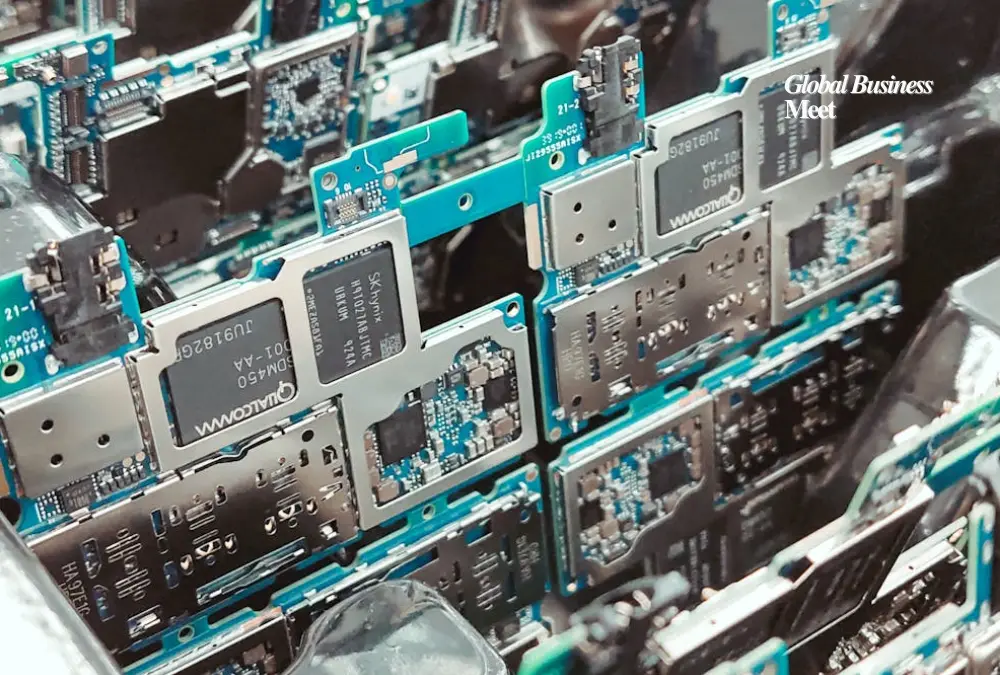

The government of the United States, under President Donald Trump is reportedly considering taking some financial interest in Intel, the American chip giant. Such a possible entry will be a unique development of government taking leverage of anchorage of the private sector to support critical local manufacturing.

A Strategic Rescue on the way

The deliberations started following a top-level assembly at the side of President Trump and Intel CEO Lip-Bu Tan. The interest of the administration has surfaced as the competency of Intel and the need to spark off existing manufacturing projects are questioned. Public capital injection may be directed to bolster Intel-which originally had received funding via 2022 CHIPS and Science Act introduced to Congress–to kick-start the long-stalled Ohio chip facility that has been beset by delays, cost overruns and schedule slips

Markets responded very quickly to the news. In normal trade, Intel indeed rose above 7% and yet another rally ensued during after-hours trade signaling a hope amongst investors based on stability guarantee by the government.

Here is why Intel matters now.

Intel no longer dominates AI chips or foundry services, industries that have been dominated by foreign competitors, but the company is the only U.S. company operating on a large scale of domestic semiconductor fabrication infrastructure. A government stake would make greater oversight and management of operations in China a direct possibility and redirect Intel towards an “America-first” industrial policy.

Besides, recent government bailouts of other tech companies seen as strategic have also demonstrated a commitment growing towards a more active stance in the development of industries that are considered critical to economic security. One of the most significant stakes would be a stake in Intel, because of its size, position in the world and the history of the company within the semiconductor industry.

Leadership In Doubt

The top level negotiations have come after months of strained relations between the President and the leadership of Intel. Trump himself has been critical of the CEO Lip-Bu Tan saying that he is concerned with alleged links in the past Chinese technology ventures. Yet, a new discourse would appear to send a different message, as both parties appear to be headed towards a similar goal–strengthening Intel as a key U.S. manufacturing plant.

This change can be twofold: one to placate the national security lobby in Washington and another to maintain itself in terms of stability within the Intel as a corporation restructures itself.

Beyond Bailouts:Reinventing Industrial Policy

In contrast to conventional corporate bailouts, the investment is part of an active form of industrial policymaking-going beyond simply subsidizing or tax breaks. An equity position would place the government in a position to directly influence strategic decision-making to keep the company on track toward larger priorities of supply chain independence and technological sovereignty.

It also has the potential of having ripple effects within the entire technological community to move toward greater dependability on the national manufacturing capabilities instead of moving offshoring to Asia, by major chip designers, such as Apple, Nvidia and AMD.

Continued Battle by Intel Intel has been struggling to uncover its business strategy amid the recent changes and transformations that have happened over the past few years. Intel has been in conflict because its business strategy has been shaken by the transformational changes which have occurred in the past few years. The strategy that Intel has been running on has not been in controversy because of different aspects that have been taken aback by the current changes and transformations which have occurred in the past few years.

The troubles of Intel are immense. The company suffered a second-quarter loss of several billions in 2025 due to poor performance in the AI chip market, a shortage of outside customers to buy its foundry services and to supply the needed heat radiated by the foundry products. In the meantime, its much-heralded Ohio semiconductor plant, labeled an anchor of the semiconductor renaissance in the U.S, is now projected to open later this decade, much longer than originally planned.

The company is in turn also working on a complex turn around strategy which consists of restructuring operations, cutting workforce numbers, and reconsidering the product roadmap of the company. Such initiatives are a welcome move, but they are not bearing market fruits as yet.

Potential Roadblocks

The concept of government stake has received a lot of hype but it is nowhere near complete. Crucial information including the amount of stake, governance privileges, funding amounts and management control is yet to be discussed. In the meantime, neither Intel nor the White House is willing to give too many details, publicizing the negotiations as merely initial.

It is not risk-free even in case the deal goes through. To revitalize Intel, capital alone will not be enough, but harsh innovation, discipline of operations and restored reputations among big customers will be needed.

The New Day in Tech Policy

The outcome notwithstanding, these discussions point towards a significant change in the American way of thinking concerning treating its most essential sectors. Through possible direct equity stakes in companies such as Intel, the government indicates that it is willing to mix market-based economics with national security policy.

When this model is successful, it would be redeeming the relationship between the public and the private sector in the advanced technology. What the move means to Intel, however, is the start of a long-sought resurrection, or, carelessly done, an addition to a troubled corporate legacy.