Earlier this year Rivian spun off micromobility upstart Also Inc., which has also recently raised a fresh round of capital, a new $200 million round led by Greenoaks Capital, giving it a post-money valuation of $1 billion. It comes on the heels of a $105 million fund in March, which had spun both Also and Rivian out of a group effort called Project Inder internally at the company (also known as Project Storefront), and invests heavily in the idea of reinventing urban electric mobility.

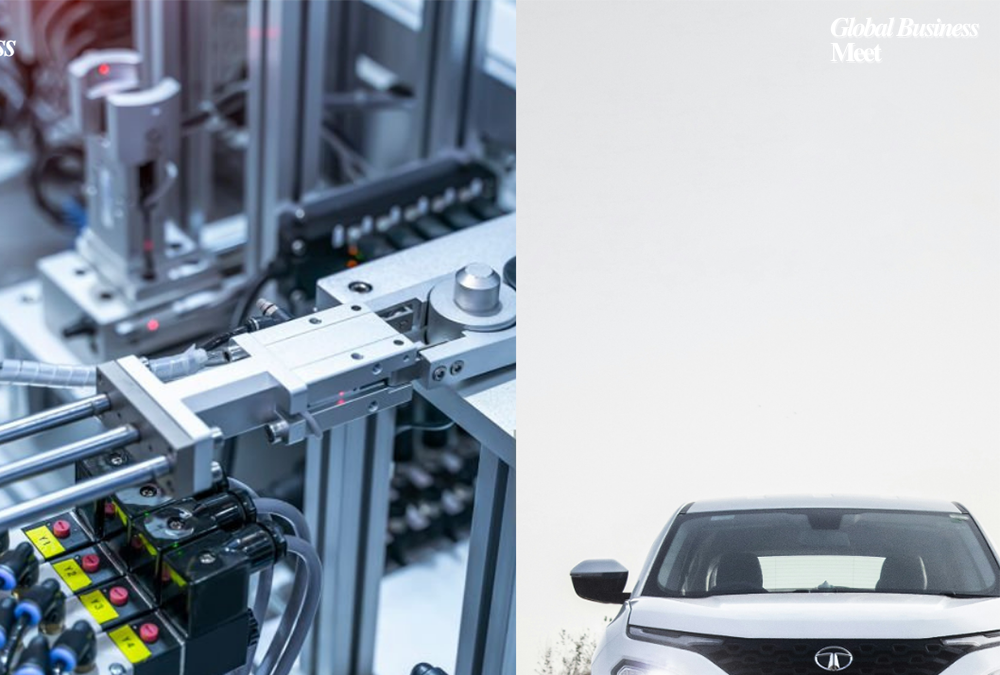

Also was started as a skunkworks of stealth in 2022 within Rivian as a group that investigated the possibility of making Rivian EV technology much smaller but ubiquitous enough to use in a much broader range of products. The creation of the first prototype of e-bike by Also was carried with collaborations with the design company LoveFrom that is headed by a former Apple designer, Jony Ive. You will recall that since then Also–still headed by Rivian veteran Chris Yu–has spun off as an independent start-up, aimed at a lineup of micro-EVs in both consumer and light commercial applications.

The fact that Greenoaks invested in Also to the tune of 200 million reaffirms the optimism surrounding the vision at Also. The funds will be invested into developing new products even more and to do more product reveals in the next coming months, increasing manufacturing capability, ramping up operations, and going global.

Also has expanded the team to include over 300 employees operating in Dubai and Madrid since the March Series A and they cover more than 40 countries with talent. This scaling is a response to the ambition of the startup to develop the advertised real estate Super App, but in the niche of micromobility, which involves the use of e-bike and scooters, and other types of light electric vehicles .

Some of the features featured in the Al horror product roadmap involve the AI-enhanced functionalities, battery and charging technology, and end-to-end digital interface. Initially in Spain, the company will carry out pilot launches of its initial line of products before expanding in to the wider European markets. It has a modular platform targeting individual consumers and commercial customers like delivery and last-mile logistics service providers.

The new Series B makes Also a European and Middle Eastern e-mobility unicorn, which is an essential milestone in an already congested industry of consolidation and innovation. It also places it in a competitive position with other EV-born startups, yet to its advantage, Rivian is well equipped when it comes to outdoor-oriented product development and manufacturing .

Early adopters have already reached the inflection point where cities are demanding more flexible and sustainable transport, now the broader micromobility world will follow. As congestion, emissions, and urban density trends motor the charging, so is demand growing for electric two– and four-wheeled micro-EVs. Also is on proportion as well in the form of its funding and its platform that proves to enable it to gain a market share in this transition.

In the case of Rivian, spinning out Also is also a strategic move of diversification as well as core heavy duty electric vehicles. Rivian owns a minority share and RJ Scaringe, the CEO of Rivian, also serves as the board chair of Also- also meaning the companies are aligned as Rivian shifts into the R2 and R3 production in 2026.

To conclude, Also is likely to grow quickly through product development and geographical expansion in Europe thanks to the $200 million funding by Greenoaks and the $1 billion valuation. The fact that it was developed in the incubator of Rivian and has a good financial support suggests that micro-EV solutions start gaining serious momentum, and sanctioned integration of all aspects of design, technology and capital could open the way to new worldwide trends in sustainable urban transportation.