Led by Signalfire, fintech startup Affiniti, founded by 20 year olds Aaron Bai and 22 year olds Sahil Phadnis, has secured $17 million in Series A funding. The good news comes after a $11 million seed round six months prior showing the rapid growth and investor belief in the company’s vision.

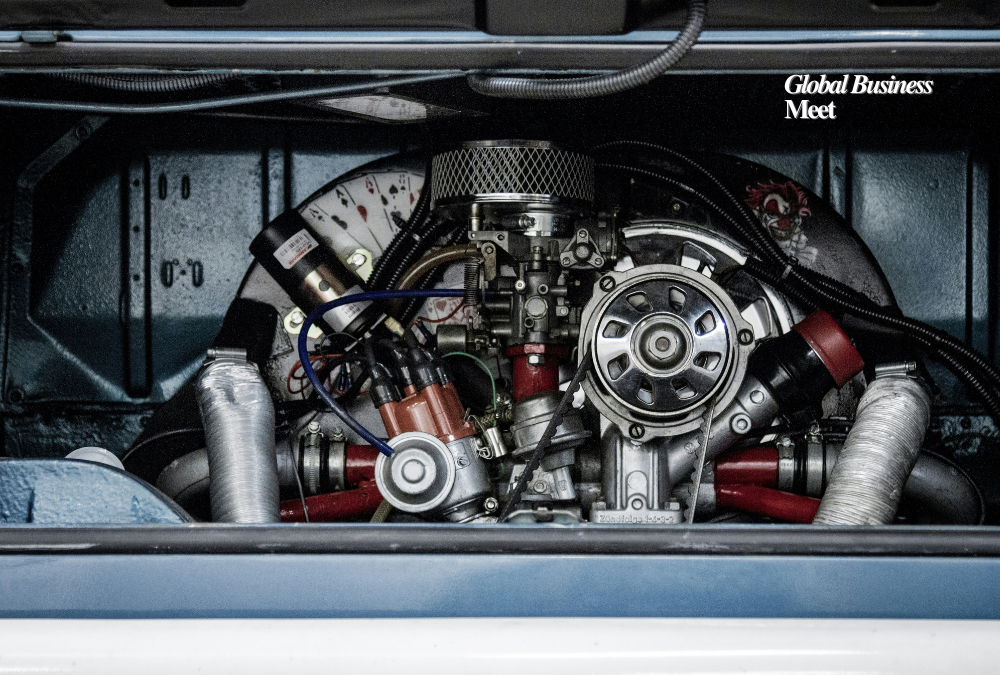

Affiniti set out to reinvent the way SMBs manage their finances through the use of AI tools that serve as the company’s virtual CFO. They have a platform that creates customizable expense management credit cards & software for industries such as healthcare, HVAC and automotive. Unlike traditional financial services, Affiniti’s solution uses real time analytics and financial advice and fills the gap for SMBs that do not necessarily have full time finance teams.

Instead, the startup’s approach which Bai calls “v3” of fintech, goes way beyond real banking (“v1”) and even the fancier UX of the Brex’s and Ramp’s of the world (“v2”). The intention is to offer actionable financial intelligence and automated services – so SMBs can make educated decisions without a great deal of financial acumen.

Affiniti which launched in November 2024, brings on 1,800 customers since launch and currently processes $20 million in transactions per month. Founders believe they will hit $1 billion worth of transaction volume by the end of the year. For the most part they make revenue off of transaction interchange fees.

‘With this Series A funding, Affiniti will grow its offerings — features like banking services, bill payment, cash flow analytics and integrations with enterprise resource planning and point of sale systems.’ The company will also develop industry specific AI agents that will provide industry specific financial guidance.

Thanks to strategic relationships with industry trade groups (such as those for independent pharmacies) Affiniti has been able to enter niche markets and have enjoyed near term tactical benefits such as group purchasing discounts. The targeted setup of the startup has helped the company to better target and cope with unique financial challenges specific to individual SMB sectors.

What’s intriguing is how, unlike many other founders, Bai and Phadnis didn’t have the support of traditional startup accelerators like Y Combinator when they built Affiniti. Funding and mentorship were secured for their network with UC Berkeley and – going out to Silicon Valley investors.

That said, as Affiniti grows Affiniti maintains its vision of helping SMBs use AI financial tools to simplify the complexities of their financials so that these businesses can flourish in a competitive market.