Headline Asia recently closed its fifth fund, Headline Asia Fund V which raised $145 million. This is a key achievement, mostly because finding money for nonprofits has become far from easy in recent times. The fund’s closure marks one of the first big new investor commitments in Asia in several months, despite pressing issues in the global market and investors feeling much more cautious.

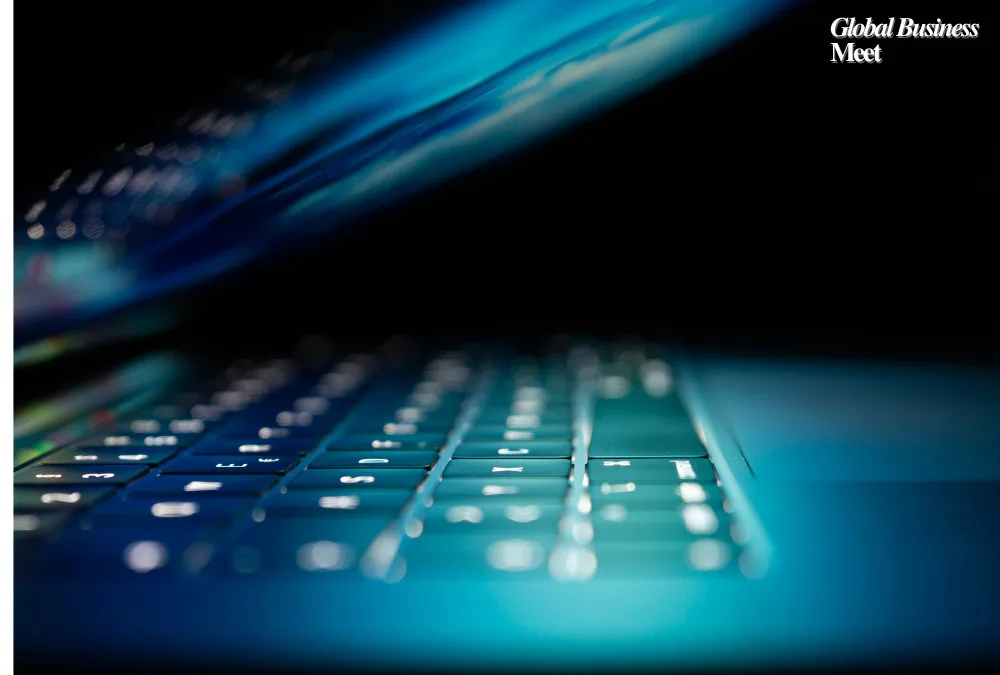

The fund will support early-stage tech businesses in the Asia-Pacific sector. It has been planned that Headline Asia will help and support ventures in e-commerce, fintech, logistics, intellectual property and artificial intelligence. Most of the time, the investment money will fall between $1 million and $5 million. The purpose of the fund is to assist startups in Japan, Taiwan, Southeast Asia and South Korea.

Public and private companies both participated in the investments of Headline Asia Fund V. Japan Investment Corporation (JIC), Taiwan’s National Development Fund (NDF), Korea Venture Investment Corporation (KVIC) and SME Support Japan are main contributors to Mentor Asia. Such a strong backing by institutions suggests they are confident in Headline Asia’s expertise in Asian markets.

Already, the fund has invested in 17 different businesses. Newmo from Japan, Jenfi based in Singapore and Pi-xcels with offices in Japan and Singapore are just a few of the portfolio companies.

Tanaka indicated that Headline Asia puts emphasis on early-stage investing in Japan’s startup scene. He observed that while Japanese startups once concentrated on domestic business, they are now looking to grow globally. Tanaka said that, at present, investing early leads to major economic rewards thanks to tighter valuations in late investments and fewer exit choices.

The new fund from Headline Asia indicates they are determined to help and invest in the next generation of Asia’s leading startups. The firm is keeping its promise to foster innovation and boost opportunities for regional entrepreneurs to succeed in the worldwide market, even with UN projects cut.