Arpit Mehta, Srijan R Shetty, and Mo Ali Yusuf founded Fuze, a digital assets infrastructure startup in July 2023, and they have successfully raised $12.2 million in a Series A funding round. The investment was made by Galaxy and e& Capital to support the company’s journey to new markets, including India. They will serve to also accelerate product development, and to help the company recruit senior talent to support its rapid growth.

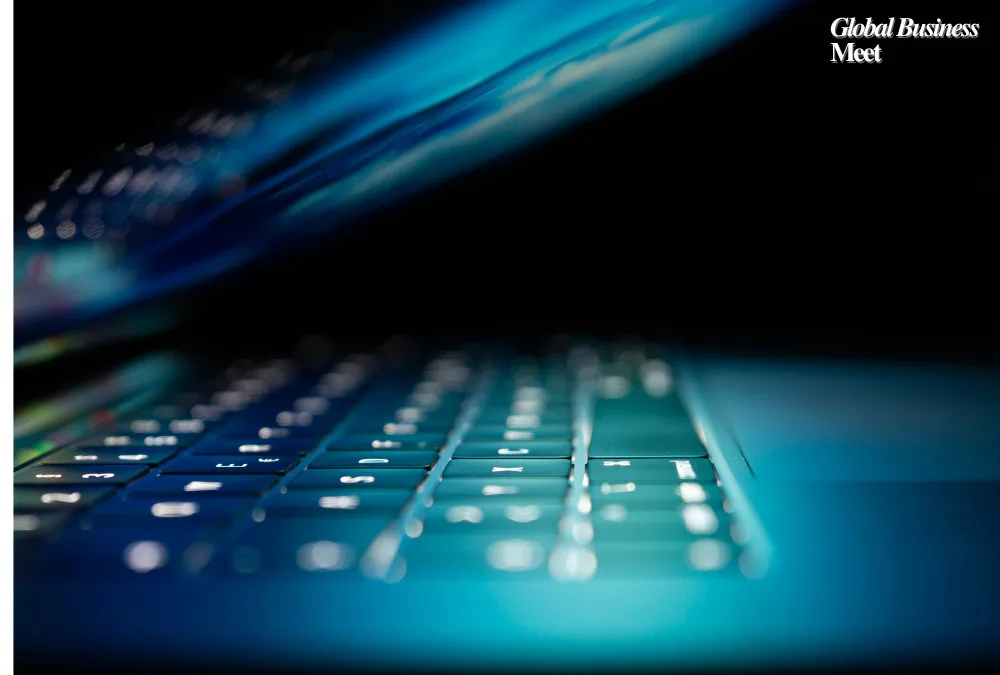

Digital Assets as a Service platform catered to the Middle East, North Africa (MENA) and Turkey with Fuze being the main player. Through this platform banks, fintech’s and traditional companies can offer regulated digital assets products such as stablecoins; cryptocurrencies; central bank digital currencies (CBDCs); tokenized assets. Since its launch, Fuze has processed over $2 billion in digital asset volume, reaffirming how much thereof demand is to its services in emerging markets.

In its expansion plans, Indian regulators are an important target for with which Fuze is actively engaging to enter Indian market. Their leadership team is eyeing with hope that the regulatory frameworks in the country are satisfied, as well as public indecision amidst India’s subsequent transformation with digital assets before going officially live in the country.

Recent years have seen Fuze take a step from just exchange and move into stablecoin infrastructure and now into payments. The company is also part of its long term ambition to become a full stack provider of digital asset infrastructure through this diversification of offerings. Before this round, the company had withdrawn $14 million in a previous round led by Further Ventures and backed by Liberty City Ventures.

The fuze leadership team is made up of professionals with immense experience at top global firms. Other members of the team held key positions at Simpl and Clear (both Arpit Mehta), Srijan R Shetty at Goldman Sachs & Microsoft, and Mo Ali Yusuf at Checkout.com and at VISA. Based on their combined expertise they have been important for developing a robust and secure platform with integration of the digital assets.

This latest round of funding will allow Fuze to be the catalyst in the digital asset infrastructure space in the world’s emerging markets. Utilizing digital assets will bring global financial services of the future and supporting the development of a digital financial system. The startup wants to empower financial institutions and businesses with tools to execute digital assets in a secured, regulatory compliant manner.