The concept of purchasing life insurance on the Internet is gaining more popularity- and justifiably so. With an increased number of insurance providers, moving to the digital environment, their buyers have an extended range of benefits and functionalities that make the whole process smooth. This is one of the reasons why it may be the best move to go to the internet.

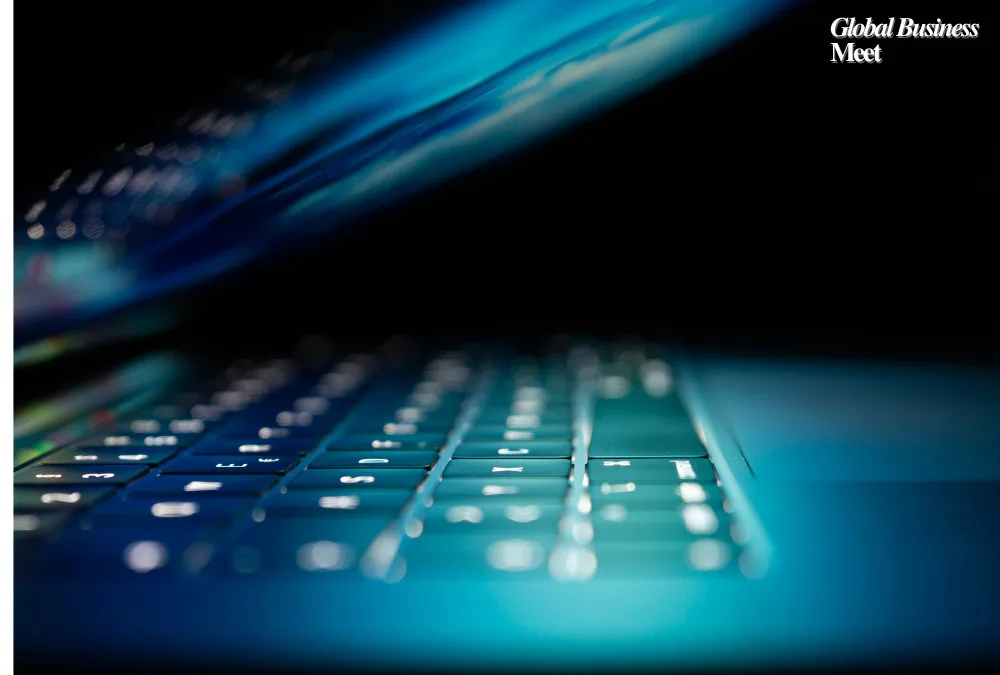

1. Convenience & Accessibility

Policy purchase is done within no specified times and places at all-it does not require one to go to an agent, or wait in a queue. As opposed to brick and mortar stores where hours of operations are limited, you can access online platforms and research and make purchase at your convenience. It is all there at your dough-pressed fingertips whether you are at home or on the move.

2. Saving on Costs and Reduction of Premiums

Insurance policies via the internet tend to be lower in prices than those in the offline platform. Agents receive no commission, overheads are reduced so the insurers transfer saving to the buyers in the form of lower premiums or they can provide the same amount of coverage at a lower price.

3. Convenient Comparisons/Side-by-Side

Insurance agents and aggregators online websites allow you to compare the features, premiums, term durations, and riders easily. Buyers are presented with a clear picture of all the available options to enable them to make a decision than dealing with one firm.

4. Swift rate of Production & Immediate Quotes

One is that with online platforms, quoted is quick and underwriting is fast. Others can also facilitate lesser approvals and upload of documents in digital formats which lower the time of waiting, as it is done in traditional methods.

5. Clear info & terms

At most platforms, you can find detailed policy information: coverage limits, exclusions, riders, renewal schedules and many others just at the touch of your fingers. You can make more informed choices with optional tools in the form of filters and educational guides.

6. Customization & Flexibility

Buyers of policy online can customize policy- included riders to cover critical illness, accidental death, or increase sum assured instantly using the calculating tools. Various options in terms of payment (single-pay, limited-pay or usual pay) increases convenience.

7. Digital Documentation & eIA assistance

All this goes digital- policy issuance, policy documents, renewal notices, and claims. Some countries such as India have the option of centralising all policies in an E-Insurance Account (eIA) like a digital demat account for insurance.

8. Confidentiality & No sales Stress

The advantage of buying online is that one is able to browse as he or she pleases without being influenced by sales agents to buy add-ons or facing the pressure of buying what they want. It is a tailor-made, self-motivated journey and revolves around the needs of the individuals.

9. Increased Security & Safe Payments

At reliable sites, there is proper encryption of data and checked means of payments. The confidential information is handled using secure gateways and risks of frauds are less probable compared to manual transactions or cash transactions.

10. Environmental & Time Efficiency

By becoming paperless, one will not only make the process faster; one will also contribute less to environmental pollution. Less printing of forms and less physical meetings result in less pollution caused by traveling and a decreased carbon footprint on a whole.

Final Thoughts

Purchasing life insurance on the Internet is not only a new trend, but also a better decision. The advantages are obvious, starting with unmatched convenience and reduced expenses, going through transparency, flexibility and sustainability. This trend is only to increase as more insurers work on honing their digital experiences.