Cash App now has a revolutionary collective Money pooling category that enables the pooling of funds in the form of group payments where both Cash App customers and non-customers could send money into the group pool. This is the next big operation of the platform which is capable of making shared spending efforts like group gifts, rent, travel expenses, or things taken up in events much simpler. Allowing non-users to access payment pools without a need to have an account is a significant feature specifically because it has opened up Cash App to people who might not be able to use it otherwise.

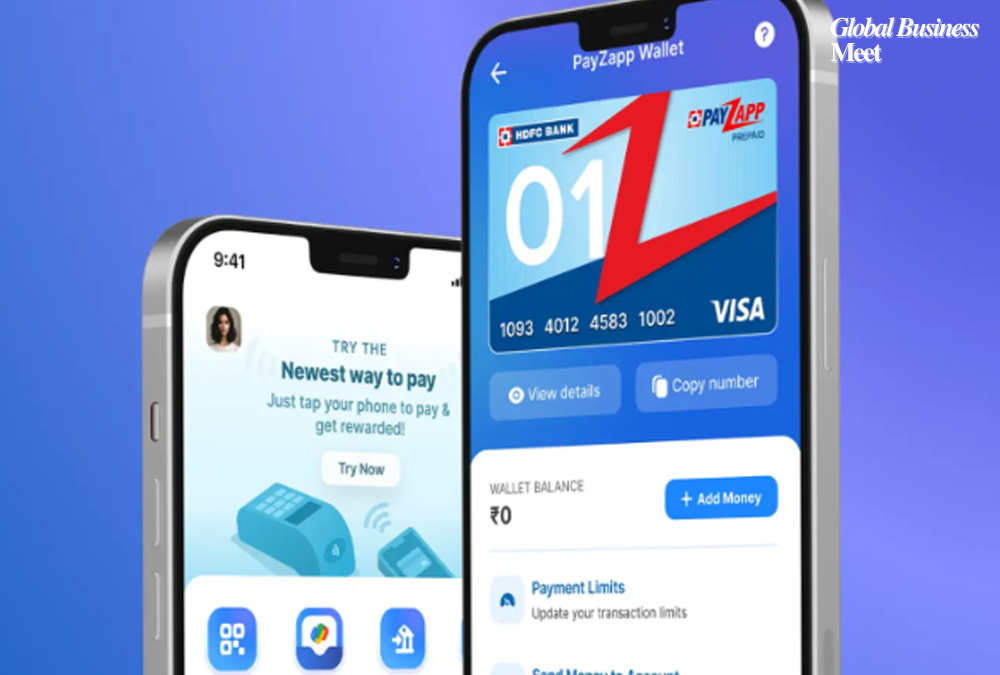

The addition of this feature allows the users to create a payment link, which can be shared via the application. This share will be accessible to be sent to friends, workmates, or any other person in a common spending. The recipients who may not be registered users of Cash App can also make their contributions through other payment methods like Apple Pay or Google Pay or through use of a credit or debit card. As soon as the contributions begin to come in, the organizer/collector will be able to know how far it has come by use of visual progress bar which will indicate the amount of money which is brought in and the amount remaining. On achieving the desired amount or miss of the deadline, the accumulated money is automatically transferred to the requester Cash App balance thereby doing away with manual tracking and calculations.

The update is beneficial to the users in many ways. To begin with, it eliminates friction because anyone can participate, whether or not they use the app. Its convenience will motivate its usage where participants do not have to download or sign up on Cash App to make a tiny deposit. Second, the feature not only extends the scope of Cash App in the payments ecosystem but it also helps tap into new audiences that could have been blocked in the past. Finally, being able to track the progress will also make the process transparent and efficient and cut confusion as to who has and hasn t paid.

It has versatile applications as seen in early uses. Say an example; people may combine their funds on behalf of birthday gifts, roommates may easily divvy rent and utilities and travelers may divvy expenditure with no mind boggling calculations. This pooling mechanism will be beneficial even to the small clubs, charity organizations or local fundraisers. The ability of link-based approach to enable participation of varied participants other than the participants within the user base of the app is also enabled.

Nevertheless, the feature also gets to pose concerns pertaining to safety, privacy, and the charges. The users complained that the links that they shared publicly could be used by the bad actors. In order to reduce the impact of this, Cash App has provided security measures, including the expiration of links, as well as optional approval of contributions, and restrictions on the sharing of such links. There is also the issue of privacy; non-user contributors do not get the entire profile of the requester thereby maintaining anonymity where appropriate. Also, credit and debit cards contributions may pay up some minimal processing fees but the same will be visible easily before hand.

In terms of strategy, such an update contributes to the competitive position of Cash App in the market of fintech products. Where many of Cash Apps competitors such as Venmo and Zelle perform the majority of the transactions as peer-to-peer transfers within their respective networks, Cash App is distinguishing itself through inclusive group payments that are not reliant on universal adoption. This is an indication of a wider trend of fintech interoperability and convenience meeting the needs of the current consumer market.

According to industry analysts, this capability can benefit profitability through acquiring new users since even the non user, upon engagement with the payment system, might want to download the application and use them in future. In addition, user engagement may be enhanced with the social component of shared costs, further solidifying social finance with Cash App.

With usability and the wide range of payment options along with extended tracking, Cash App has designed a product that facilitates one of the financial annoyances. The new way of using the application leads to not only a better experience of using the app, but also to an increase in the number of potential users, solidifying its reputation as a top innovator in peer-to-peer payments and group solutions.