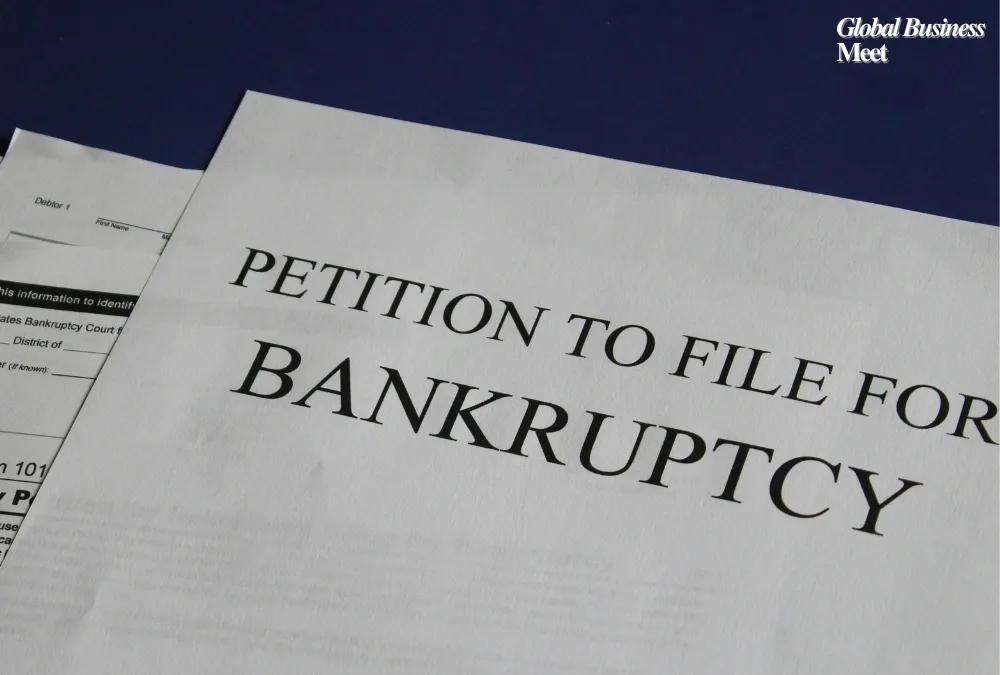

Fintech BaaS startup Solid called both Dragons Den and is now the subject of a Chapter 11 bankruptcy filing in US Bankruptcy Court in the District of the Delaware. Previously called Wise, the Palo Alto based business, had raised funding from investors such as Headline and FTV Capital which totaled to almost $81.61 million. But solid was valued at money in August last year, when it grew 10 times to a revenue and 100 times increase in the number of its clients to 100.

Solid provides a set of easy to integrate APIs to build a suite of financial services such as banking, payments, cards, and cryptocurrency products intended for the fintech and vertical SaaS companies. Early successes were offered by the company, which however later started losing the ability to collect more capital and ended up in costly litigation. Last year, Series B investor FTV Capital sued Solid around the co-founders misrepresented revenues and churn to investors (Arjun Thyagarajan and Raghav Lal), per documents filed in Santa Clara county Superior Court. In response Solid denied the claims calling FTV an aggressive private equity firm that was resorting to unproven allegations. In April 2024, the case was settled and dismissed with prejudice.

Solid had approximately $760,000 of unsecured trade debt and over $7 million of cash on hand with $2 million in non liquid reserve accounts as of the filing, according to the documents. Cutting its workforce to three people, the company is now unprofitable. Under subchapter V of Chapter 11, Solid is looking to restructure or sell its business. The sale of Beams is being attempted through a court supervised sale process, and with a suitable buyer, Thyagarajan expressed confidence that it would end positivley for the company, its customers as well as its shareholders.

Solid bankruptcy is a part of a broader item affecting the BaaS market. In April 2024, another BaaS startup Synapse Financial Technologies filed for bankruptcy leaving thousands of trust customers without the money. These developments have raised concerns over the stability and regulatory supervision of the fintech businesses in the market of BaaS service.