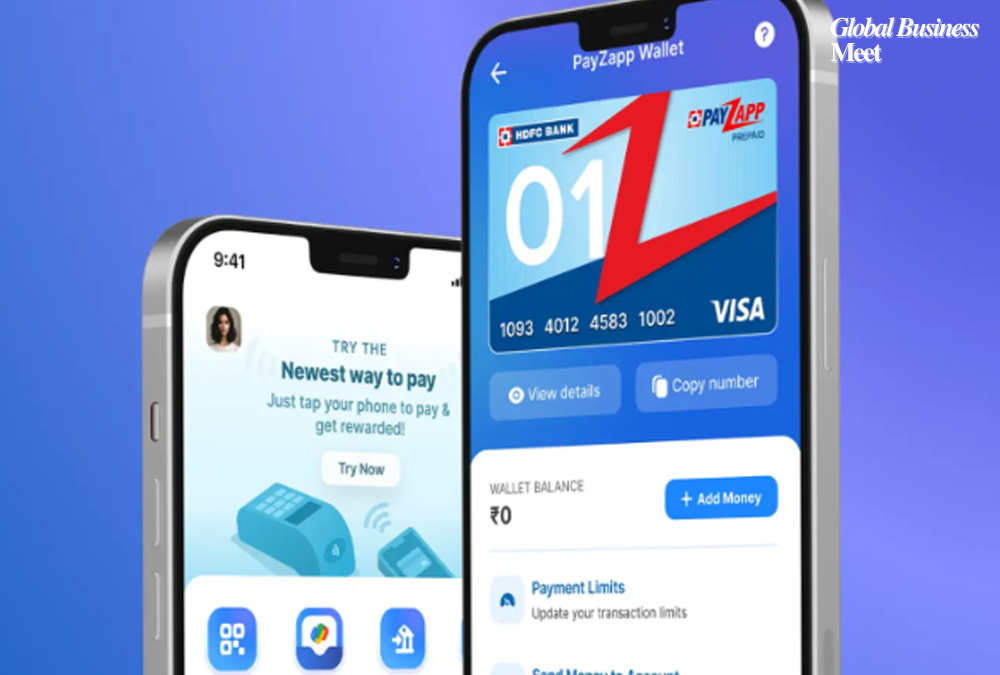

PayPal recently launched a groundbreaking international payment system called PayPal World combining China-based Tenpay Global (WeChat Pay) and India-based Unified Payments Interface (UPI), which is run by the government. The program is among the radical steps toward letting more than 2 billion customers with PayPal and Venmo usage pay internationally using their domestic wallets.

Indian consumers will be able to buy goods sold by merchants in the United States or global stores by using their UPI mobile payment app with PayPal when the PayPal World becomes live. It will not require them to create an account with PayPal. In the same manner, when you are in China and have a PayPal or a Venmo, you can scan the WeChat Pay QR codes to comfortably settle with the local shops. The platform will also introduce Latin America, Mercado Pago and other regional digital wallets so this expands global interoperable coverage.

Market Penetration Strategic Benefits

This is an ecosystem that facilitates cheap instant remittance and international trade without frictions or fee. In June 2025 alone, UPI had more than 238 billion processed and WeChat Pay has more than 1.3 billion users, and it emerges as an enormous cross-border payment network.

Connecting these systems, PayPal World becomes a single channel connecting local standards of wallets with internationally-recognized merchant acceptance.

The decision of PayPal highlights its strategic vision of continuing growth of digital commerce and financial inclusion in the long-term perspective. Having earned RBI permission to act as an international payments aggregator in India, enjoying strong partnerships with NPCI and Tencent, PayPal is shaping up as a vendor-agnostic facilitator, instead of being a payments gate keeper.

The PayPal World Functioning

Indian UPI users are able to buy goods in U.S based e-commerce sites by applying UPI as an option after selecting PayPal during the payment process.

WeChat Pay clients can accept funds sent by PayPal or Venmo customers and pay at merchants in China.

Very shortly, the Venmo customers will also be able to make international payments in local currencies on behalf of the recipients.

Its design is on an international level and has consumer-friendly features as it combines regulations compliance in remitting and stability of foreign exchange.

Economic & Technical implications

PayPal World lowers the reliance on the traditional card rails, SWIFT transfers, or banking networks. It uses national payment framework (UPI and Tenpay) to speed up adoption process and cut costs. Analysts regard this integration as an organizational change in fintech, a cross-currency payment run by regionally trusted wallets, and dyed together under a common interface.

As PayPal can connect to local wallet with no need to build new access rails, PayPal can deploy fast and without major infrastructure change, which makes PayPal truly and immediately beneficial to the SMB Exporter of India as well as any global consumer.

Issues & Regulatory Issues

On the one hand, the opportunities are high, and PayPal is obliged to operate in obscure regulatory environments, such as the data localization requirements in India, and bans on remittances and fintechs in China, as well as the FATF <<travel rule>> requirements to track transactions. The process of further cooperation NPCI and Tencent will be necessary to guarantee consistency with the law and consumer confidence.

The Future is in Front

A cross-border payments equivalent to PayPal world is anticipated in the autumn of 2025, and Venmo users will have their cross-border payment use by 2026. The platform will probably be broadening the list of integrated wallets to reach more local wallets, and make the systems globally interoperable that have previously existed as siloes.

The next generation of innovations will incorporate support of stablecoins, agentic payment buttons and dynamic wallet switching, which provide frictionless, context-adaptive checkout flows that follow the user preference.